So it’s finally happened to me. My health insurance company has refused.

So it’s finally happened to me. My health insurance company has refused.

I’ve always considered myself and my family blessed to have good insurance. We’ve had our share of medical emergencies and long-term issues and with a little hard work and a lot of time on hold, we’ve gotten good coverage through the years.

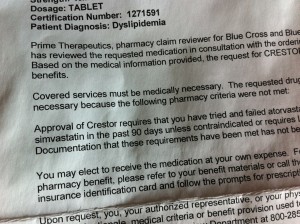

So this is my first outright rejection. They don’t want to pay for Crestor anymore, because my cholesterol no longer needs to be reduced more than 40 percent. So precisely because it worked — dropping my LDL from 180 to 58 — I no longer need it. Sure, that makes perfect sense.

They’ll reconsider if I “try and fail” the generic brands, so lucky me, I get to start testing new medications and dealing with new reactions, interactions, and side effects. I’m especially looking forward to the muscle pain I hear comes with Lipitor; despite the mega-dose of Crestor I was on, I had managed to escape that. Muscle pain + marathon training = good times.

And then there’s the anxiety of new drugs. I don’t especially love that I’m on 14 pills a day, but at least I’m used to them all and I know what they do to me. Spending the next year trying and failing sounds like a new roller coaster ride of emotions and stress.

The most frustrating thing about this is that it seems that insurance would rather pay for another heart attack than keep refilling Crestor for the next 50 years (I’m optimistic, even when mad). They must have fed my data into their algorithms and concluded I was a low risk and therefore worth the extra cash in hand today. They feel comfortable with the risk; too bad I don’t.

I know that this is a minor setback and that for millions of others, denied coverage is a much, much bigger issue — one of life and death, not of anxiety and inconvenience. It happens. To many.

It shouldn’t.

Recent Comments